Community

6

2016

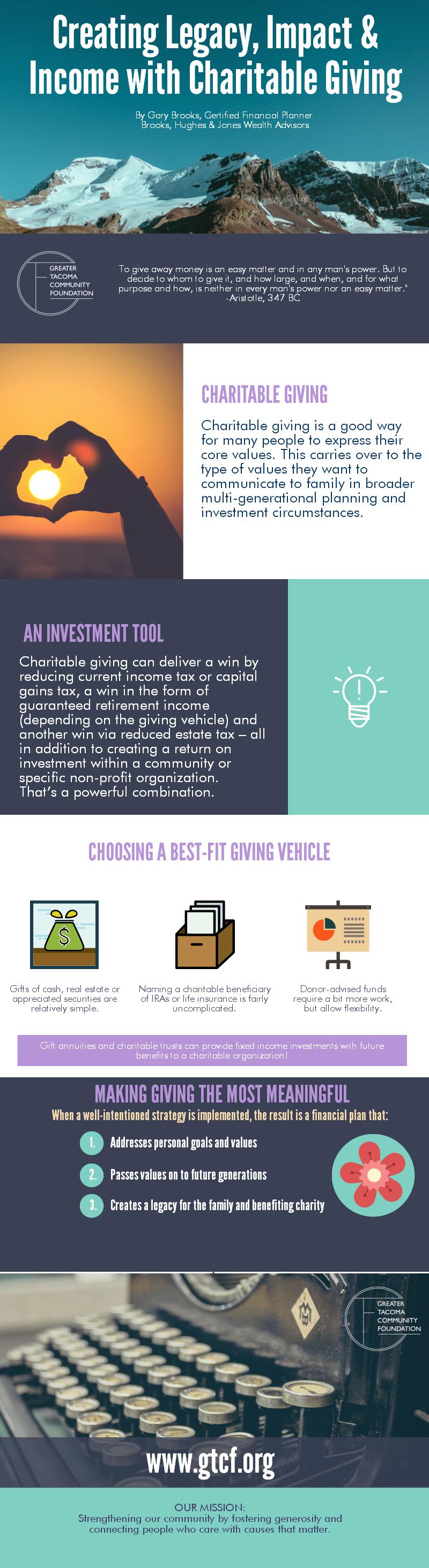

Creating Legacy, Impact and Income with Charitable Giving

“To give away money is an easy matter and in any man’s power. But to decide to whom to give it, and how large, and when, and for what purpose and how, is neither in every man’s power nor an easy matter.”

~ Aristotle, 347 BC

I read this quote about four years ago, close to the time I joined the Board of Directors of the Greater Tacoma Community Foundation. Having been a member of the GTCF Vibrant Community Grants committee before then, I had first-hand experience how challenging many giving decisions are.The mission of the GTCF is noble and much good work has been done to benefit our community. But it is not always easy to determine exactly how much to give or how to best put charitable dollars to work.

As the current GTCF Investment Committee chair, it could be easy to focus solely on the investing decisions for the various funds we manage but I think it’s also important to keep in mind the destination of these funds. They are used to support non-profit organizations, fund scholarships and generally contribute to the greater good of Tacoma and Pierce County.

Fortunately, the GTCF staff is exceptionally talented and has built a solid bridge between donors / fundholders and the organizations best positioned to utilize this money to inspire change.

Giving at the Center for a Plan

In my career as a Certified Financial Planner, I’ve found the most enjoyable clients to work with are those where charitable giving crosses over several disciplines of financial planning. First, charitable giving is a good way for many people to express their core values. This carries over to the type of values they want to communicate to family in broader multi-generational planning and investment circumstances. Those values and the desire to leverage the many wins of charitable giving can lead to situations where income tax, estate planning and investment management all integrate with philanthropy.

Charitable giving can deliver a win by reducing current income tax or capital gains tax, a win in the form of guaranteed retirement income (depending on the giving vehicle) and another win via reduced estate tax – all in addition to creating a return on investment within a community or specific non-profit organization. That’s a powerful combination.

Since Aristotle’s time, the options for giving in a tax-efficient, financially-smart manner have grown more varied and complex.

Choosing a Best-Fit Giving Vehicle

There is certainly a full spectrum of ways to give. Outright gifts of cash, real estate or appreciated securities – either while living or via bequest – are relatively simple. Naming charitable beneficiaries of IRAs or life insurance is another fairly uncomplicated option. Donor-advised funds require a bit more work but allow great flexibility. And if a donor needs to retain some form of the gifted asset to support retirement income or other use, gift annuities or charitable trusts can be an attractive alternative to other fixed income investments.

Most often, we help clients implement giving through just one or two of these strategies. But which one is right for any given situation requires that we evaluate each opportunity. We also help clients with the “what if?” questions about when to give and how much to give while protecting their own financial security even if they live particularly long lives.

We always intend to integrate the needs of families and charities to make giving the most meaningful. When a well-intentioned strategy is implemented, the result is a financial plan that:

- Addresses personal goals and values

- Passes values on to future generations

- And creates a meaningful legacy for the donor/family and the organizations the donor supports.

The Greater Tacoma Community Foundation is well-suited to be a partner in achieving these goals.

Gary Brooks, Certified Financial Planner

GTCF Board Member

253.534.8888 or gary@bhjadvisors.com.